Married Filing Jointly Tax Deduction 2024

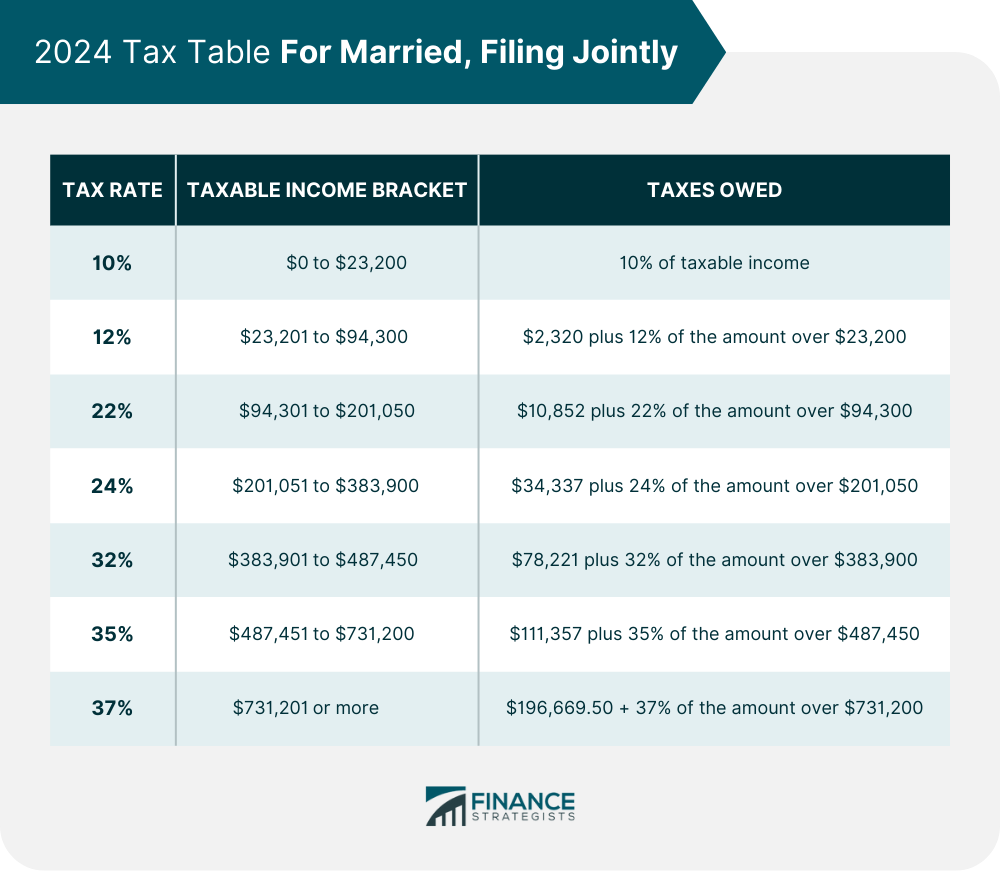

Married Filing Jointly Tax Deduction 2024. The tax rate for couples (joint filing) earning under $450k will be preserved the tax rate for individuals (single filing) earning under $400k will be preserved however, with that in mind. Although you have $150,000 in net investment income, you will pay 3.8% in niit only.

The calculator below can help estimate the financial impact of filing a joint tax return as a married couple (as opposed to filing separately as singles) based on 2024 federal income tax brackets. The calculator automatically determines whether.

Married Filing Jointly Tax Deduction 2024 Images References :

Source: brennayatlante.pages.dev

Source: brennayatlante.pages.dev

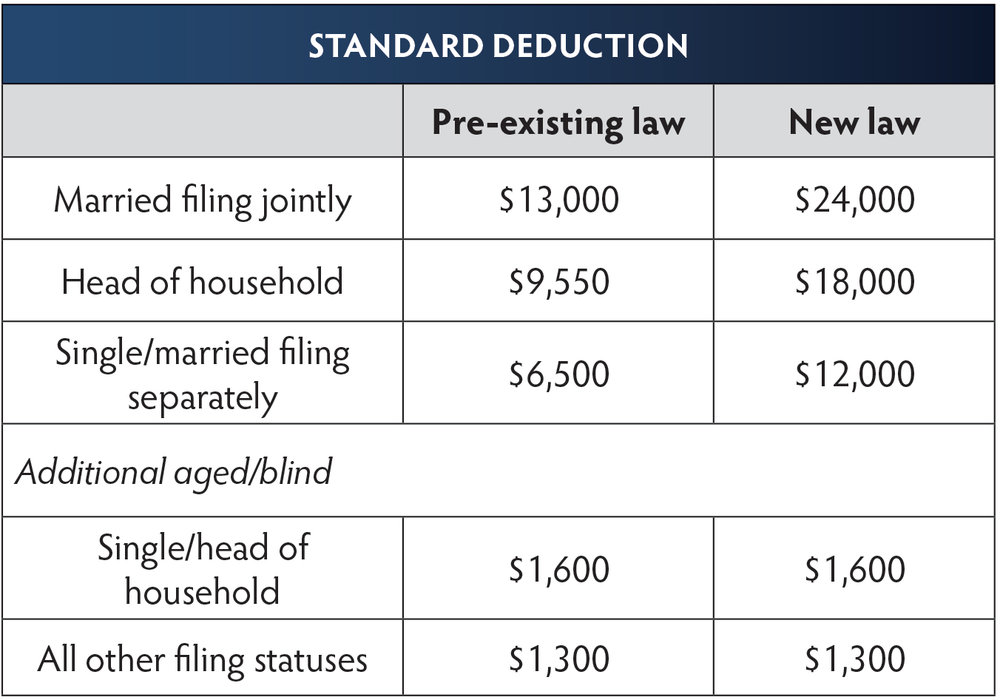

2024 Standard Deduction Married Carey Correna, The married filing jointly and qualifying surviving spouse standard deduction increased by $1,500.

Source: www.trustetc.com

Source: www.trustetc.com

2024 Tax Brackets Announced What’s Different?, As the new tax year approaches, it's essential for married couples to be aware of the latest tax brackets for married filing jointly in 2024 and 2025.

Source: adrianewaleta.pages.dev

Source: adrianewaleta.pages.dev

Standard Tax Deduction 2024 Married Jointly Standard Deduction Brinn, For married couples filing jointly, that threshold is just $731,200 — far from double.

Source: charleanwgerry.pages.dev

Source: charleanwgerry.pages.dev

2024 Married Filing Jointly Tax Brackets Golda Gloriane, What are the rules for married filing jointly?

Source: taxedright.com

Source: taxedright.com

2024 Tax Brackets Taxed Right, The married filing jointly and qualifying surviving spouse standard deduction increased by $1,500.

Source: fyi.moneyguy.com

Source: fyi.moneyguy.com

The IRS Just Announced 2023 Tax Changes!, As the new tax year approaches, it's essential for married couples to be aware of the latest tax brackets for married filing jointly in 2024 and 2025.

Source: boxden.com

Source: boxden.com

Oct 19 IRS Here are the new tax brackets for 2023, You may deduct up to $10,000 ($5,000 if married filing separately) for a combination of property taxes and either state and local income taxes or sales taxes through a tax break.

.png) Source: daynabjunette.pages.dev

Source: daynabjunette.pages.dev

Standard Tax Deduction 2024 Filing Jointly Alene Aurelie, Find the 2024 tax rates.

Source: daynabjunette.pages.dev

Source: daynabjunette.pages.dev

Standard Tax Deduction 2024 Filing Jointly Alene Aurelie, For tax year 2024, the standard deduction is $14,600 for single filers, $29,200 for married couples filing jointly, and $21,900 for heads of households.

Source: cahrabmaighdiln.pages.dev

Source: cahrabmaighdiln.pages.dev

Standard Deduction 2024 Married Filing Jointly Rafa Ursola, The amt exemption amount for 2024 is $85,700 for singles and $133,300 for married couples filing jointly (table 3).

Posted in 2024