2025 Nevada Sales Tax

2025 Nevada Sales Tax. This is a printable nevada sales tax table, by sale amount, which can be customized by sales tax rate. Our free online nevada sales tax calculator calculates exact sales tax by state, county, city, or zip code.

The base state sales tax rate in nevada is 4.6%. The nevada sales tax rate for 2023 is between 4.6% and 8.265%.

Learn More About The Local State Sales Tax Rates Here.

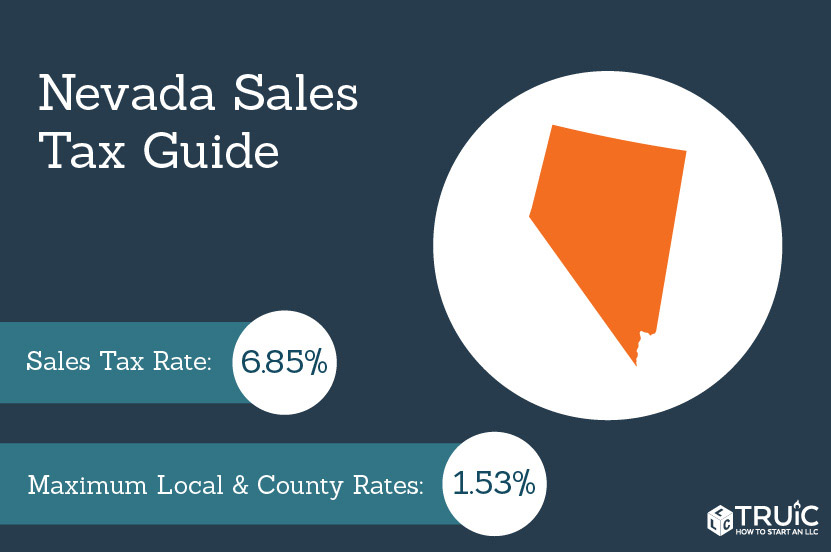

The nevada sales tax rate is 6.85% as of 2024, with some cities and counties adding a local sales tax on top of the nv state sales tax.

Explore Nevada Sales Tax Faqs For Information On Rates, Filing Procedures, And Compliance.

This threshold applies to all.

2025 Nevada Sales Tax Images References :

Source: www.salestaxhelper.com

Source: www.salestaxhelper.com

Nevada Sales Tax Guide for Businesses, This comprises a base rate of 4.6% plus local rates up to 3.625%. Nevada sales tax due dates.

Source: howtostartanllc.com

Source: howtostartanllc.com

Nevada Sales Tax Small Business Guide TRUiC, Our free online nevada sales tax calculator calculates exact sales tax by state, county, city, or zip code. Groceries are exempt from the storey county and nevada state sales taxes.

Source: www.salestaxsolutions.us

Source: www.salestaxsolutions.us

Sales Tax in Nevada Nevada Sales Tax Registration, The calculator will show you the total sales tax amount, as well as. The nevada sales tax rate for 2023 is between 4.6% and 8.265%.

Source: www.paulmartinsmith.com

Source: www.paulmartinsmith.com

State Of Nevada Sales Tax Rates By County Paul Smith, Nevada has 249 cities, counties, and special districts that collect a local sales tax in addition to the nevada state sales tax. The nevada sales tax rate is 6.85% as of 2024, with some cities and counties adding a local sales tax on top of the nv state sales tax.

Source: formspal.com

Source: formspal.com

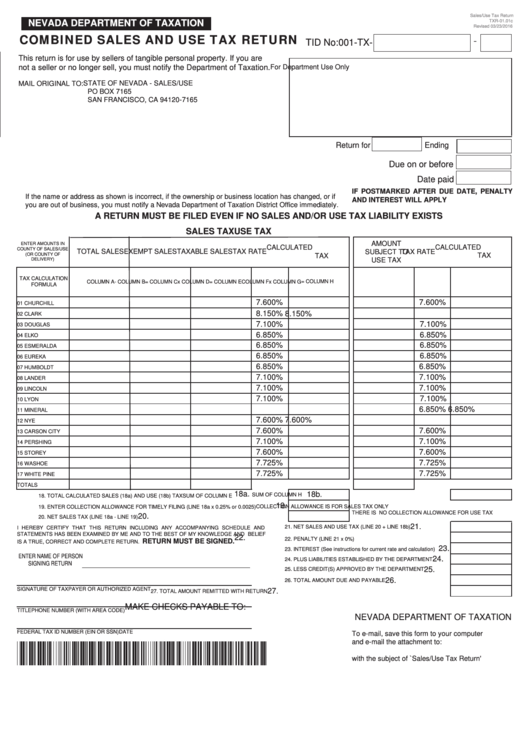

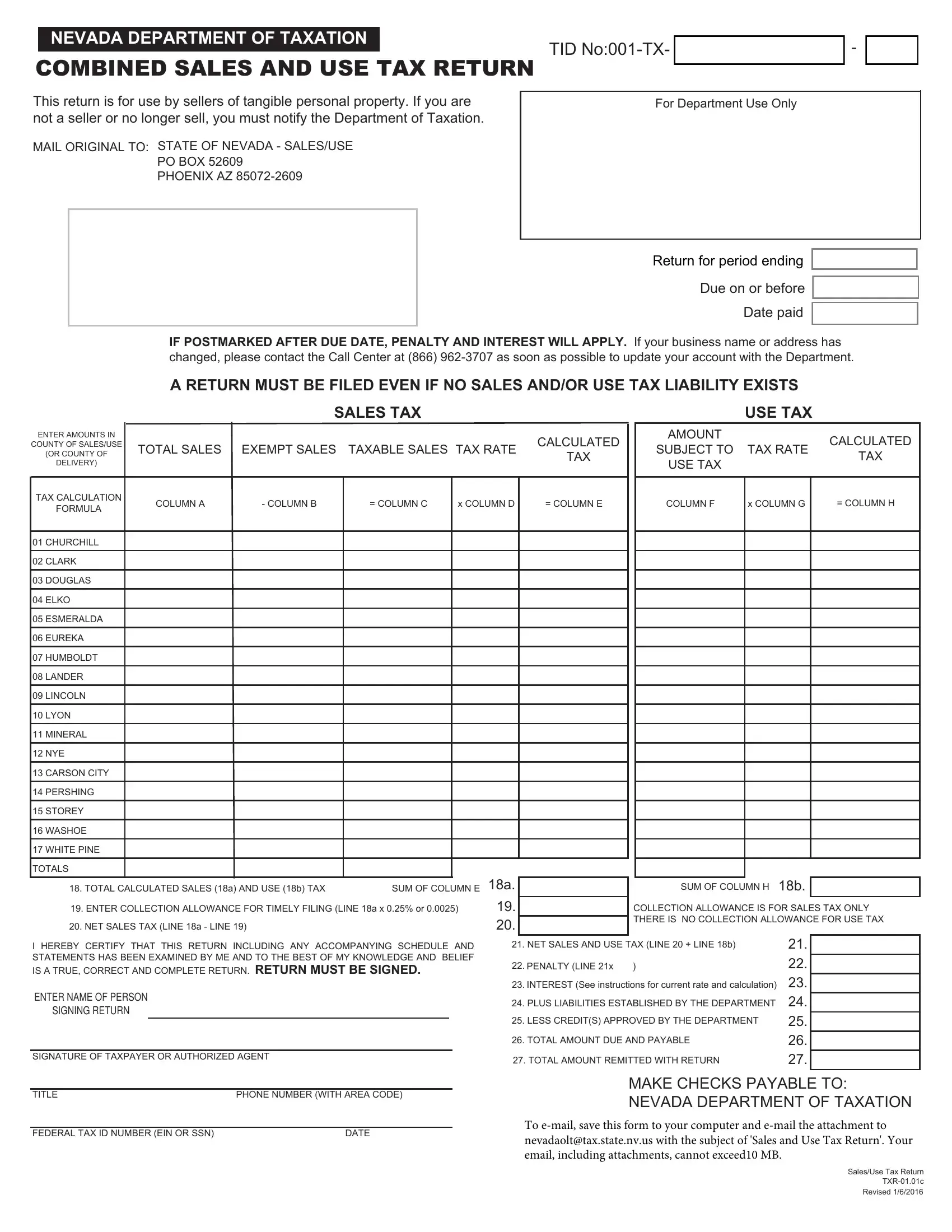

Nevada Sales Tax Form ≡ Fill Out Printable PDF Forms Online, Nevada sales tax calculator is used to calculate the sales tax to buy things in nevada. The sales tax calculator will calculate the cost of an item with and without tax.

Source: www.anrok.com

Source: www.anrok.com

Is SaaS taxable in Nevada? The SaaS sales tax index, Nevada sales tax calculator is used to calculate the sales tax to buy things in nevada. Additional sales tax is then added on depending on location by local government.

Source: zamp.com

Source: zamp.com

Ultimate Nevada Sales Tax Guide Zamp, Our dataset includes all local sales tax jurisdictions in nevada at state, county, city, and district levels. You can use our nevada sales tax calculator to look up sales tax rates in nevada by address / zip code.

Source: www.semashow.com

Source: www.semashow.com

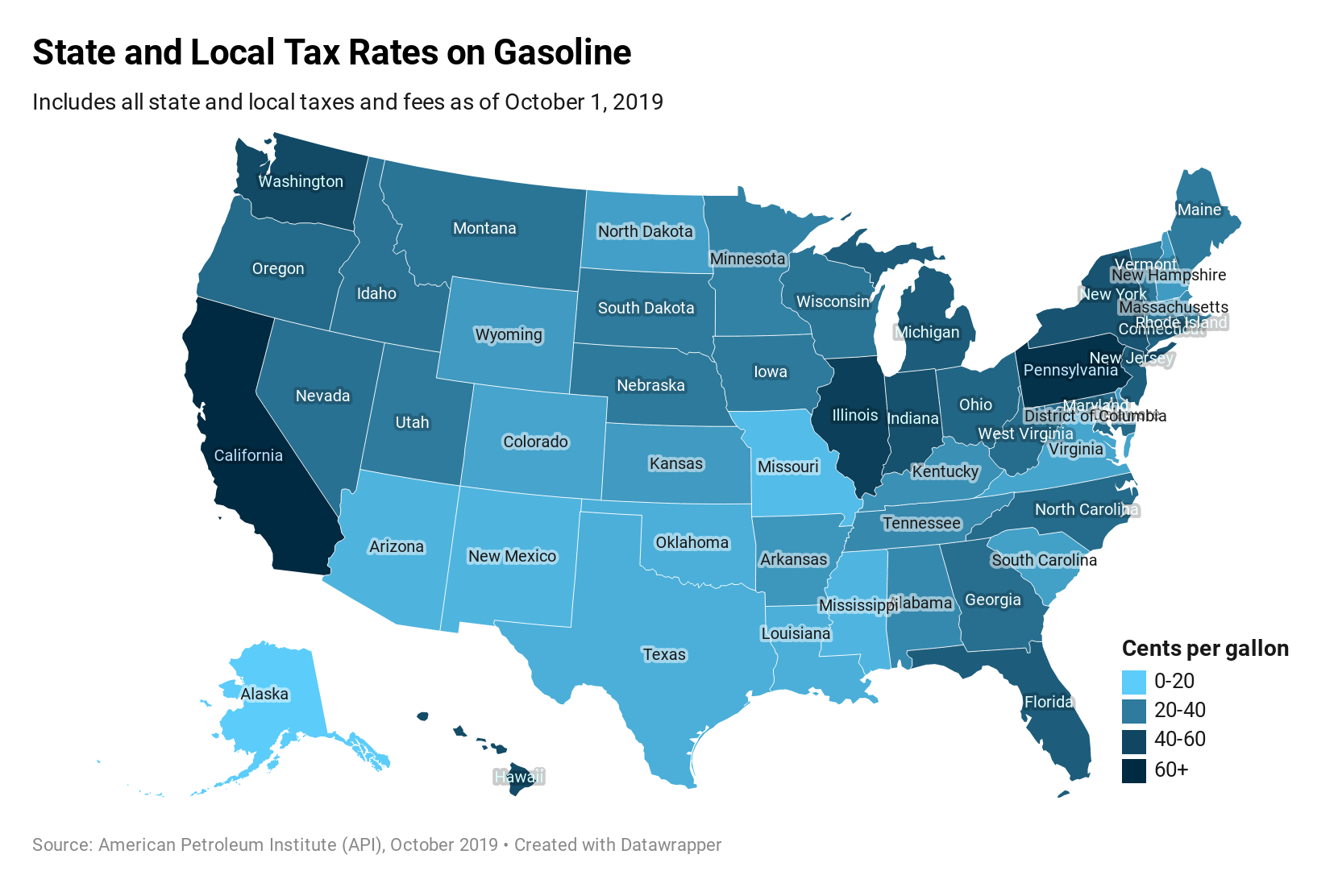

Nevada Sales Tax On Motor Vehicles, Local tax rates in nevada range from 0% to 3.665%, making the sales tax range in nevada 4.6% to 8.265%. Nevada sales tax due dates.

Source: literacybasics.ca

Source: literacybasics.ca

Forms Nevada Sales Tax Literacy Basics, Groceries are exempt from the clark county and nevada state sales taxes. Our free online nevada sales tax calculator calculates exact sales tax by state, county, city, or zip code.

Source: itep.org

Source: itep.org

Nevada Who Pays? 6th Edition ITEP, Our dataset includes all local sales tax jurisdictions in nevada at state, county, city, and district levels. 107 rows nevada has state sales tax of 4.6% , and allows local.

Our Dataset Includes All Local Sales Tax Jurisdictions In Nevada At State, County, City, And District Levels.

The key to nevada sales tax compliance lies in understanding your nexus status, knowing which products and services are taxable, and accurately calculating, collecting, and.

With Local Taxes, The Total Sales Tax Rate Is Between 6.850% And 8.375%.

Groceries are exempt from the storey county and nevada state sales taxes.

Posted in 2025